Galveston College

Financial Aid

Galveston College offers many financial aid options to help you pay for college costs.

Financial Aid FAQ and Resources

Financial aid is money that helps you pay for college. Financial aid can be a combination of scholarships, grants, loans, and work-study.

Grants (free money)

- Federal Pell Grant

- Federal Supplemental Educational Opportunity Grant (SEOG)

- Texas Public Education Grant (TPEG)

- Texas Educational Opportunity Grant (TEOG)

Loans (borrowed money that you pay back)

- Federal Direct Loan

- Direct PLUS Loans

- Private Loans

Work-Study (part-time work)

- Students with work-study position will work part-time on or off- campus while enrolled.

- Students will be allowed to work 10-19.5 hours per week.

- View available positions

Scholarships (free money)

- Universal Access Scholarship

- Galveston College Scholarships

- Outside Scholarships

- Galveston College Emergency Scholarship

Important Deadlines for 2026-2027 FAFSA® & State Aid

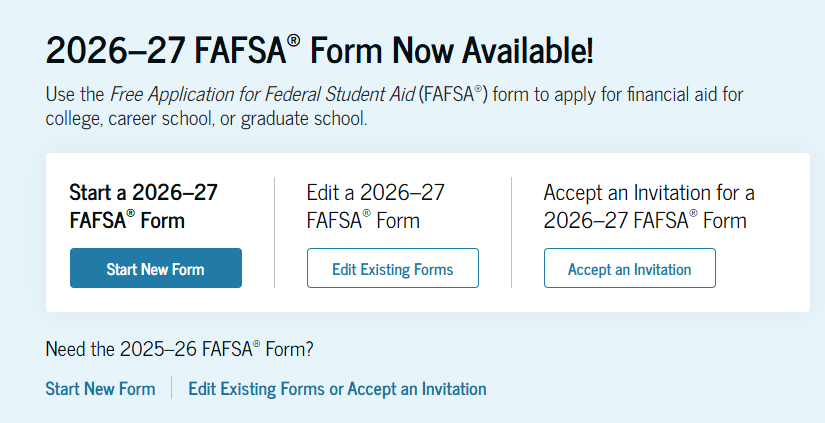

The 2026-2027 FAFSA® is now open!

- Galveston College FAFSA® Deadlines:

- For Fall 2026: June 9, 2026

- For Spring 2027: November 9, 2026

- For Summer 2027: March 30, 2027

- Texas State Financial Aid Deadlines:

- Priority Deadline: February 15, 2026, for all state program.

- It is a good idea to submit your FAFSA® and any other required documents before this date.

- The last day to submit the 2026-2027 FAFSA® is June 30, 2027.

Important Deadlines for 2025-2026 FAFSA® & State Aid

The 2025-2026 FAFSA® is now open!

- Galveston College FAFSA® Deadlines:

- For Fall 2025: June 9, 2025

- For Spring 2026: November 9, 2025

- For Summer 2026: March 30, 2026

- Texas State Financial Aid Deadlines:

- Priority Deadline: February 15, 2025, for all state program.

- It is a good idea to submit your FAFSA® and any other required documents before this date.

- The last day to submit the 2025-2026 FAFSA® is June 30, 2026.

2026-2027 FAFSA Now Open!

Gather the documents below:

- Social Security number

- Alien registration number

- FSA ID account and password

- 2024 Federal tax information or tax returns

- Records of untaxed income

- Cash, savings, and checking account balances

- Investments other than the home in which you live

- Your Contributor information

- Name

- Date of Birth

- Social Security Number (SSN)

- Email Address (to invite to complete their required portion of the FAFSA®)

Create an FSA ID at: StudentAid.gov

An FSA ID is a username and password that gives you access to Federal Student Aid’s online systems and can serve as your legal signature. Only create an FSA ID using your personal information and for your exclusive use. You are not authorized to create an FSA ID on behalf of someone else, including a family member.

- How to create an FSA ID video

- What to do if I forgot my FSA ID/ Password:

- If you have an FSA ID but do not remember your username, select Forgot My Username

- Note: If you verified your email address or mobile phone number during account creation,

you can enter your email address or mobile phone number instead of your username.

- If you have an FSA ID but do not remember your password, select Forgot My Password.

- Your password must be between 8 and 30 characters in length, and it must contain at least one uppercase letter, one lowercase letter, and one number. Special characters are not required, but the following characters may be included as part of your password:

- ! # $ % & ( ) * + – . : ; < = > ? @ [ ] ^ _ { } ~

- Remember, your password is case-sensitive.

Gather the documents below:

- Social Security number

- Alien registration number

- FSA ID account and password

- 2023 Federal tax information or tax returns

- Records of untaxed income

- Cash, savings, and checking account balances

- Investments other than the home in which you live

- Your Contributor information

- Name

- Date of Birth

- Social Security Number (SSN)

- Email Address (to invite to complete their required portion of the FAFSA®)

Create an FSA ID at: StudentAid.gov

An FSA ID is a username and password that gives you access to Federal Student Aid’s online systems and can serve as your legal signature. Only create an FSA ID using your personal information and for your exclusive use. You are not authorized to create an FSA ID on behalf of someone else, including a family member.

- How to create an FSA ID video

- What to do if I forgot my FSA ID/ Password:

- If you have an FSA ID but do not remember your username, select Forgot My Username

- Note: If you verified your email address or mobile phone number during account creation,

you can enter your email address or mobile phone number instead of your username.

- If you have an FSA ID but do not remember your password, select Forgot My Password.

- Your password must be between 8 and 30 characters in length, and it must contain at least one uppercase letter, one lowercase letter, and one number. Special characters are not required, but the following characters may be included as part of your password:

- ! # $ % & ( ) * + – . : ; < = > ? @ [ ] ^ _ { } ~

- Remember, your password is case-sensitive.

Go to: StudentAid.gov and log in using your FSA ID.

Click on Start New Form if you haven't completed the 25-26 or 26-27 FAFSA®, to access

an existing form click "Access Existing Form"

If you are a new student, click Create an Account If you have completed a FAFSA® before, click on Log In.

To start the application, click on "student"

Before you can access the FAFSA® form online, you’ll need to create a StudentAid.gov account. Every contributor(parent/spouse), including the student, must have an account to access and complete their sections of the form. If you don’t have a Social Security number, you’re still able to create an account.

The 2025-2026 is for the following semester: Fall 2025, Spring 2026 and Summer 2026

- Have your and/or your spouse’s/ parent(s) income available for 2023

The 2026-2027 is for the following semester: Fall 2026, Spring 2027 and Summer 2027.

- Have your and/or your spouse’s/ parent(s) income available for 2024.

Galveston College’s Federal School Code: 004972

Now you are ready to submit a FAFSA®! Need assistance? You may call 1-800-433-3243. CLICK TO CALL

Other steps to take to get Financial Aid

- All new and returning students must have a current admissions application on file with the Admissions Office. New students must have their final official high school transcript, GED® certificate, homeschooling record or, ATB Alternative on file. Transfer students must have ALL FINAL OFFICIAL transcripts from any and all institutions of higher education on file with the Admissions Office.

- Grant consent for your Federal Tax Information (FTI) to be brought into the FAFSA® through the DDX.

- Provide consistent information.

- Read all instructions.

- Use your legal name — not nicknames — and your correct social security number.

- If your parents are divorced, you must report information for the parent who has provided the most financial support during the past 12 months. This may be the parent you lived with the most, but not necessarily. If that parent is remarried, you are also required to include your stepparent’s income. Be sure to provide all requested information about your parents.

- Make sure you include 004972 on your list of school codes.

- If you complete the FAFSA® electronically, don’t forget to sign using your FSA ID (a username and password). You (the student) will need an FSA ID as well as your parent(s). These are two separate FSA IDs.

- Make a copy of your completed FAFSA® and all documents submitted to the Financial Aid Office for your records.

- Check your Whitecaps email frequently and respond to all requests from the Financial Aid Office as soon as possible.

For questions regarding any of the above steps:

Contact Financial Aid Office at:

| Name |

Meghann Nash Degges |

| Title | Director of Financial Aid |

| Room | M-170 |

| Program Area | Financial Aid |

| Phone | 409-944-1235 |

| Financial Aid Email | [email protected] |

Questions? Contact Us.

Financial Aid Office

Monday - Tuesday

8:00 AM - 7:00 PM

Wednesday - Friday

8:00 AM - 5:00PM

[email protected]

409-944-1235

409-944-1505